What to Expect From Your Complimentary Consultation

A No-Pressure, No-Cost First Step

Your initial consultation with Vineyard Wealth Group is completely complimentary, with no obligation to move forward. This is your opportunity to ask questions, explore your financial goals, and understand whether our guidance can meaningfully support your long-term plans.

Confidentiality You Can Trust

Everything you share during your meeting is strictly confidential. As a fiduciary investment advisor led by a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional, we are committed to maintaining your privacy, protecting your information, and always acting in your best interest.

How to Prepare for Your Meeting

Bringing the right information helps us create a clear and accurate picture of your financial life. But please don’t worry about having everything perfectly organized. Some people bring in extensive documentation, some people bring in none. We’re here to meet you where you are. Everyone comes in at a different place, and it’s normal to feel a mix of emotions around money. We offer clarity, not judgment.

The more numbers you can provide, the more specific our guidance can be. However, nothing needs to be formal or complete. Simply gather whatever you already have on hand. Even partial or incomplete information is useful. And if you’re someone who likes to get everything down in writing, our fact finder is available here.

Possible Items to Bring

Insurance & Risk Management

Life, disability, long-term care, or umbrella insurance policies

Employer-provided benefits summaries

Health savings account (HSA) details

Estate Planning

Existing wills or trusts

Beneficiary statements

Powers of attorney or healthcare directives

Goals & Priorities

Retirement timeline

Major life goals (home purchase, education funding, business planning, charitable giving)

Any questions or concerns you want to address

Financial Overview

Recent investment account statements (401(k), IRA, brokerage accounts, etc.)

Bank account summaries

Current allocation or retirement plan statements

Stock options or equity compensation details

Income & Cash Flow

Most recent pay stubs or income documentation

Social Security benefit estimates

Budget or spending outline

Taxes

Most recent tax return (last year’s 1040 + schedules)

Receipts of any charitable giving

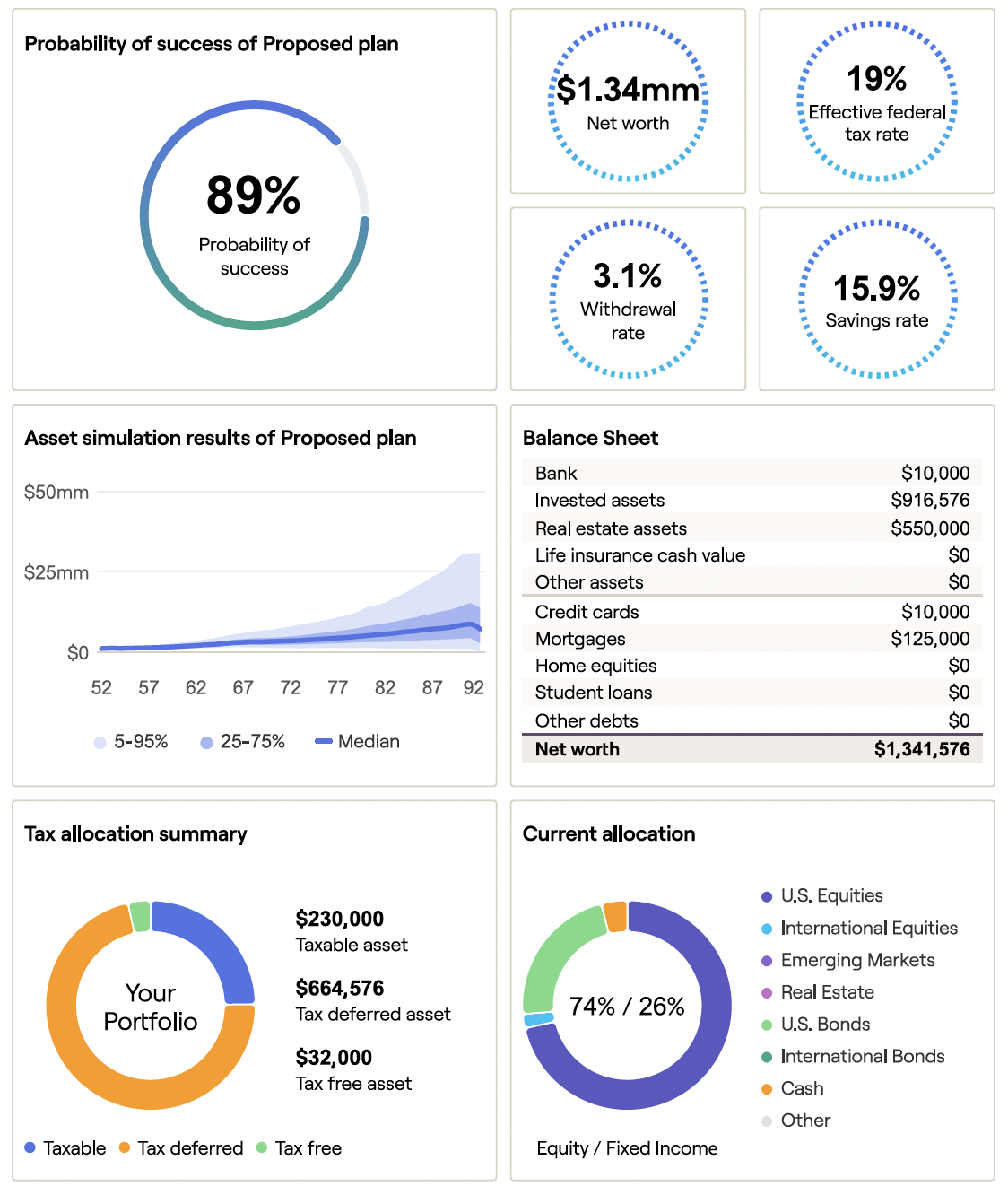

An example of a financial plan.

What Will Happen During the Consultation

1. We Get to Know You

We’ll discuss your goals, priorities, and concerns, whether you’re planning for retirement, optimizing investments, addressing taxes, evaluating risk, or just looking for some general guidance and perspective.

2. We Review Your Financial Picture

We’ll walk through your documents together and help you identify strengths and opportunities across investments, taxes, retirement planning, and estate considerations.

3. We Provide Initial Guidance

You’ll leave the meeting with clarity, actionable insights, and a sense of the strategies that may support your financial future. We’ll enter information that you provide into planning software to model what your financial life and retirement may look like.

4. We Follow Up

After the meeting, we’ll send you a follow-up email that summarizes our meeting, highlights any specific next steps that were discussed, and provides a draft Financial Plan (see sample here). We will likely model your situation in a manner similar to what you see in the attached sample plan. This outline is something that we provide everyone, whether or not they have any intent to work with us on an ongoing basis.

5. You Decide What Comes Next

After the consultation, you’re in complete control. Some clients choose to move forward with ongoing planning or investment management; others simply take the insights from the meeting. There is never any pressure or commitment.