What Market Volatility Reminds Us About the Power of Financial Planning

The markets have had a rough stretch again. Since mid-February, the S&P 500 has dropped more than 17 percent. The headlines are full of recession concerns, inflation worries, and geopolitical uncertainty. It’s a lot to take in.

In moments like this, fear is understandable. The uncertainty feels real because it is. But it’s also a reminder of why financial planning is so important.

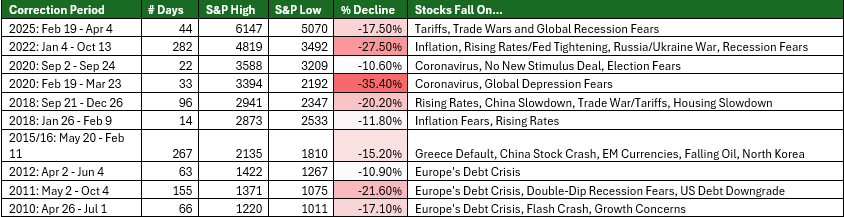

Since 2010, there have been more than ten market corrections that each pulled the S&P 500 down by 10 percent or more. Some were tied to global debt concerns. Others were driven by pandemics, political turmoil, or fears of runaway inflation. At the time, each of those corrections felt different and deeply uncomfortable. And yet, when we zoom out, a pattern emerges: the people who stayed invested and stuck to their plans were the ones best positioned to recover and grow over time.

S&P 500 Corrections of Greater than 10% since March 2009 low (*as of 4/4/2025)

To help put things in perspective, consider this. If an investor had moved to cash in April 2010 at the height of Europe’s debt crisis and stayed there, their $100,000 would have grown to about $125,000. That same investment left in the S&P 500 would be worth more than $478,000 over that same period (as of 4/4/25).

The difference isn’t just in the return. It’s in the discipline.

This doesn’t mean fear is wrong. It means fear, by itself, is not a strategy. That’s where planning comes in.

For those near or in retirement, a thoughtful financial plan often includes holding four to five years of planned expenses in fixed income, after accounting for sources of guaranteed income like Social Security or pensions. This gives people the breathing room to avoid selling stocks in a downturn, while also letting the equity portion of the portfolio recover over time. Planning like this doesn’t eliminate volatility, but it can make it much easier to endure.

And while the current environment feels recessionary, it’s worth remembering that many of the policy tools being used today — things like tariffs, tax reductions, and lower interest rates — are inflationary in nature. If the COVID era taught us anything, it’s that holding too much cash can also carry risks. When prices rise quickly, cash can lose its purchasing power just as fast.

No one knows exactly what happens next. But trying to guess isn’t the goal. The goal is to create a plan that supports your needs and priorities regardless of short-term market movements.

A well-built financial plan gives you the ability to stay grounded when everything else feels uncertain. That’s not just about asset allocation. It’s about creating space for better decision-making when it matters most.

Disclaimer: This content is for informational purposes only and should not be considered investment advice. Past performance is not indicative of future results. Investing involves risk, including the potential loss of principal. Always consult with a qualified financial professional before making decisions based on your specific situation.